The Program The SBA 504 Loan Program is an

economic development program designed to facilitate capital investment and job

creation and/or retention on a local level. Through certified development

companies such as Black Hawk Economic Development, Inc. (BHED), in conjunction

with the U.S. Small. Business Administration (SBA), reasonable fixed interest

rate financing is available for qualifying small business projects.

SBA 504 Service Area

At present,

Black Hawk Economic Development Inc.'s SBA 504 program service area includes

the above shaded counties in the State of Iowa. At present,

Black Hawk Economic Development Inc.'s SBA 504 program service area includes

the above shaded counties in the State of Iowa.

IowaBlack Hawk Economic Development, Inc.'s

Primary SBA 504 program service area includes Allamakee, Black Hawk, Bremer,

Buchanan, Butler, Chickasaw, Clayton, Fayette, Grundy, Howard, and Winneshiek

Counties in the State of Iowa. Other counties are serviced on a case by case

basis.

Eligible BusinessesTo be eligible for the SBA

504 Loan Program, a business must meet the SBA Program definition of a small

business including but not limited to:

- For profit

- Independently owned and operated

- Not dominant in its field of operation

- Tangible net worth of less than $15 million

- After federal income tax net income for the two

years immediately preceding the application cannot exceed $5 million per year

on average

Local AdministrationThe SBA 504 Loan Program is

administered on a local level by Black Hawk Economic Development, Inc. As such,

the organization markets the program, processes applications, and provides loan

servicing functions on a local level under the direction of SBA.

General RequirementsA loan applicant must:

- Be of good character and/or good standing

- Demonstrate ability to operate the business

successfully

- Possess adequate capital to operate the business on

a successful basis

- Demonstrate sufficient past and/or future earnings

to repay the loan

- Provide adequate business collateral to assure loan

repayment

Use of FundsThe SBA 504 Loan Program is a fixed

asset finance program. As such eligible use of funds include the acquisition of

fixed assets only and which meet minimum program useful life standards. The

fixed assets must be utilized in the ordinary course of the business.

Eligible uses of funds:

- Acquisition of land or building

- Building construction/improvement

- Purchase of machinery and equipment with a minimum

useful life of ten (10) years (with exceptions)

- Other direct eligible costs associated with a

project (e.g. appraisal, construction interest)

- Refinance of existing debt (limitations apply)

Ineligible uses of funds:

- Non fixed assets

- Working capital

- Machinery and equipment with a minimum useful life

of less than ten (10) years

- Accounts receivable/inventory, etc.

- Passive holding of real estate i.e. apartments

- Speculative purposes

|

|

Project ReviewSBA 504 Program applications are

first reviewed on a local level by BHED. SBA concurrence or approval is also

required. Program guidelines:

- Number of jobs to be created/retained as a result

of the project. Project must generally meet the threshold of one job created/

retained per $65,000 of Program funding.

- Amount of SBA 504 Program assistance requested. The

maximum SBA participation or exposure is typically limited to $1,500,000 ($2

million for projects that meet public policy goals).

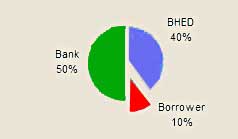

- Typical funding structure of 50-40-10

- Under the Program, no more than 50% of the project

financing can be federal in nature.

- Other terms and conditions apply.

The Funding ProcessThe SBA 504 Loan Program is

typically thought of as "take out" financing. Once an application is approved

by BHED (with the concurrence of SBA), a loan commitment or authorization is

issued disclosing the terms and conditions for program participation. The bank

then advances against the authorization with construction or interim financing

for the project. Upon completion of the project, BHED proceeds with the loan

closing followed by debenture funding 4 to 6 weeks later.

CollateralProgram loans must be adequately

collateralized to assure repayment of the loan. The collateral is typically

limited to the project assets and the personal guaranty of owners having

greater than 20% ownership. Additional collateral may be required if the

project assets are not sufficient.

Terms And Interest RatesSBA 504 Loan Program

loans are for ten or twenty year terms (only). In order to obtain the most

favorable bond rate, a declining prepayment penalty applies during the first

half term of the loan. The loan interest rate is not set or known until the

debenture or bond is priced following completion of the project and the loan is

closed. Once priced, the debenture interest rate is fixed for the term of the

loan. The interest rate most often quoted is in terms of the ten or twenty year

effective rate, which includes the various on going fees.

Application ProcessDevelop a Business Plan, to

include

- Summary of a sound business project

- Organizational structure/management

- Marketing plan

- Schedule of project cost(s)

- Proforma financial statements (i.e. Balance Sheets,

Income Statements, and Cash Flow Statements)

- Historical financial statements, to include tax

returns (3 most recent years; personal and business).

Commercial Lender Review

All projects

are initially reviewed by a commercial lender to determine the financial

institution's participation. If applicable, the lender may then refer the

applicant to BHED for SBA 504 Program assistance in the project

Complete the Financial Assistance Application

If your

business and/or project is eligible, and a financial gap is identified, contact

us at:

Black Hawk Economic Development, Inc.

1001 Peoples Square

Waterloo, Iowa 50702

Phone: (319) 235-2960

Fax: (319) 235-9171

Email:

bhed@bhed.org

Click here for a copy of the 504 Application Checklist.

|