PurposeThe primary purpose of the Black Hawk IRP

Loan Fund Program (IRP Program) is to promote new business startup, expansion,

and/or retention projects in rural areas. In fulfilling its purpose, Black Hawk

Economic Development, Inc. seeks to foster capital investment, as well as, job

creation and retention. In addition to business projects, the Black Hawk IRP

Loan Fund fosters community objectives by providing financing for qualifying

community based projects.

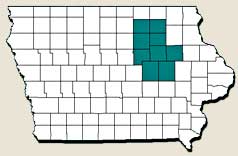

IRP Program Service Area

IowaThe Black Hawk IRP Program service area

includes rural areas and communities in Benton, Black Hawk, Buchanan, Grundy,

and Tama Counties and portions of Bremer, Butler, Chickasaw, and Floyd

Counties, all in the State of Iowa.

Eligible ApplicantsTo be eligible for the Black

Hawk IRP Program, a business must meet the generally accepted definition of a

small business: for profit, independently owned and operated, and not dominant

in its field of operation. The business must also certify it will employ at

least 10% of workers from members of families with income below the poverty

line and that no delinquent debt to the federal government exists. IRP Program

projects are reviewed on a competitive basis with emphasis on those projects

whose primary operation involves manufacturing, commercial services, or

wholesaling of commercial goods. In addition to qualifying businesses,

communities and community based organizations may apply.

ObjectiveThe goal of the Black Hawk IRP Fund is

to improve the economic well being of the rural service area through sound

economic/community development strategies and practices, to include:

- Increased new business startup, business expansion

and retention activities

- Increased diversification of the economic base and

development of exporting and minority opportunities

- Sustained/increased employment opportunities (new

jobs and job advancement)

- Increased capital investment, and property and

sales tax revenues

Local AdministrationThe Black Hawk IRP Program

is administered by Black Hawk Economic Development, Inc. on a local level with

the Loan Committee responsible for program supervision. As such, the Loan

Committee reviews loan applications for compliance with the organization's IRP

Plan and makes the decision as to the local participation in a project. The

Loan Committee is also responsible for loan servicing issues (e.g. loan

extensions, collateral subordination, etc.).

Type of Business AssistanceThe Black Hawk IRP

Fund Program is a "gap financing" program, which provides direct financial

assistance to rural small business/communities that cannot obtain reasonable

financing on a conventional basis.

General RequirementsA loan applicant must:

- Be of good character and/or good standing

- Demonstrate ability to operate the business

successfully

- Possess adequate capital to operate the business on

a successful basis

- Demonstrate sufficient past and/or future earnings

to repay the loan

- Provide adequate business collateral to assure loan

repayment

|

|

|

|

Use of Funds Eligible Use of Funds

- Acquisition of real estate (to include land,

building, etc.)

- Building construction or improvement

- Purchase of machinery or equipment

- Working capital*

* Community loans not eligible for working

capital |

Ineligible Use of Funds

- If credit is otherwise available on reasonable

terms and conditions

- If the loan is to solely pay off a loan to another

creditor to reduce its risk

- A loan for agricultural or speculative purposes

- A loan to an enterprise primarily engaged in

lending or investing activities or whose principal income is derived from

gambling activities

- If the loan encourages monopoly, or is inconsistent

with the accepted standards of the free competitive enterprise system

- If the loan is used to relocate a business from one

commuting area to another or inside or outside of a target area

CollateralBlack Hawk IRP Program loans must be

adequately collateralized to assure repayment of the loan. Personal guaranty(s)

generally apply.

Collateral for a loan may consist of a security

interest or lien on one or more of the following:

- Accounts Receivable

- Inventory

- Machinery and Equipment

- General Intangibles

- Commercial Real Estate

- Fixtures on Real Estate

- Chattel paper

Additional collateral may be required if the project

assets are not sufficient in relationship to the total project cost(s).

Project ReviewBlack Hawk IRP Program

applications are reviewed on a competitive basis with consideration given to

the following items:

- Type of business

- IRP Program job leverage (loan request divided by

number of jobs created/retained)

- IRP Program financial leverage (IRP dollars divided

by IRP dollar requested)

- Local economic impact

- Business Plan

- Requested loan term and conditions

- Applicant's financials, to include credit reports,

collateral and cash flow analysis

- Applicant's participation; typically at least ten

percent (10%) of total project cost

Application ProcessDevelop a Business Plan, to

include

- Summary of a sound business project

- Organizational structure/management

- Marketing plan

- Schedule of project cost(s)

- Proforma financial statements (i.e. Balance Sheets,

Income Statements, and Cash Flow Statements)

- Historical financial statements, to include tax

returns (3 most recent years)

Commercial Lender Review

All projects

are initially reviewed by a commercial lender to determine the financial

institution's participation in the project and the identification of a

financial gap.

Complete the Financial Assistance

Application

If your business and/or project is eligible, and a financial

gap is identified, contact us at:

Black Hawk Economic Development,

Inc.

1001 Peoples Square

Waterloo, Iowa 50702

Phone: (319) 235-2960

Fax: (319) 235-9171

Email: bhed@bhed.org

|